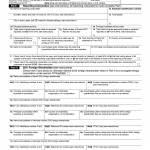

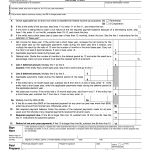

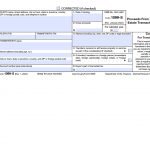

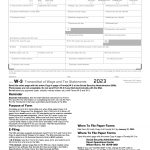

IRS Form W-3. Transmittal of Wage and Tax Statements

Form W-3, Transmittal of Wage and Tax Statements, is a tax form used by employers to transmit employee wage and tax information to the Social Security Administration (SSA). This form is a summary of all the W-2 forms issued to employees and is required to be filed annually.