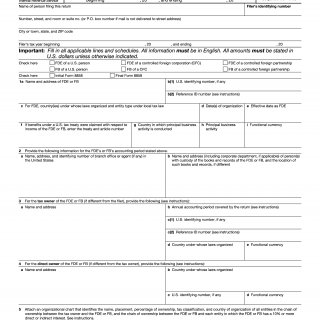

IRS Form 8858. Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs)

Form 8858, Information Return of U.S. Persons With Respect to Foreign Disregarded Entities (FDEs) and Foreign Branches (FBs) is a tax form used by U.S. taxpayers who own foreign disregarded entities or foreign branches. The main purpose of the form is to provide the Internal Revenue Service (IRS) with information about these entities and to ensure that U.S. taxpayers are complying with tax laws related to foreign investments.

The form consists of several parts, including general information about the taxpayer, information about the foreign disregarded entity or foreign branch, and financial information about the entity or branch. It is important to complete all sections of the form accurately and completely, as failure to do so may result in penalties or other consequences.

The important fields to include in the form are the taxpayer's name, address, and taxpayer identification number, as well as information about the foreign disregarded entity or foreign branch, such as its name, address, and tax classification. Additionally, the form requires financial information about the entity or branch, such as its income, assets, and liabilities.

When completing the form, it is important to have all necessary information and documentation available. This may include financial statements, tax returns, and other relevant documents. It is also important to understand the tax laws and regulations related to foreign investments, as failure to comply with these laws may result in penalties or other consequences.

Some examples of applications and use cases for Form 8858 include U.S. taxpayers who own foreign disregarded entities or foreign branches, such as corporations, partnerships, or limited liability companies. This form may also be required for taxpayers who have foreign investments or holdings, such as foreign bank accounts or securities.

Strengths of Form 8858 include its ability to provide the IRS with important information about foreign investments and to ensure that U.S. taxpayers are complying with tax laws related to these investments. Weaknesses may include the complexity of the form and the potential for errors or omissions. Opportunities include the ability for taxpayers to take advantage of tax benefits related to foreign investments, such as tax credits or deductions. Threats may include the potential for penalties or other consequences for noncompliance with tax laws related to foreign investments.

Related forms or analogues to Form 8858 include Form 5471, Information Return of U.S. Persons With Respect to Certain Foreign Corporations, and Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships. The main differences between these forms are the types of entities they apply to and the specific information required.

To fill and submit the form, taxpayers should follow the instructions provided by the IRS. This may include submitting the form electronically or by mail. The form should be stored in a safe and easily accessible location for future reference.

In summary, Form 8858 is a tax form used by U.S. taxpayers who own foreign disregarded entities or foreign branches. It consists of several parts and requires accurate and complete information about the taxpayer and the foreign entity or branch. The form is important for ensuring compliance with tax laws related to foreign investments and may have tax benefits or consequences.