IRS Form 3115. Application for Change in Accounting Method

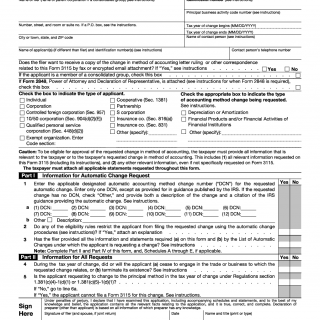

Form 3115: Application for Change in Accounting Method is a tax form used by businesses or individuals to request permission from the Internal Revenue Service (IRS) to change their accounting method. The form consists of several parts, including general information, a description of the requested accounting method change, and any relevant attachments or schedules.

Important fields to consider when completing Form 3115 include the taxpayer's name, address, and employer identification number (EIN). It's also important to provide a detailed description of the current and proposed accounting methods, as well as the reason for the change.

Parties involved in the process of completing Form 3115 include the taxpayer and their tax advisor, as well as the IRS. It's important to note that the IRS may request additional documentation or information to support the application for the accounting method change.

Examples of application scenarios for Form 3115 include changes in depreciation methods, changes in inventory valuation methods, and changes in the timing of income or expense recognition. Strengths of the form include its ability to provide clarity and transparency in the accounting method change process. Weaknesses may include the potential for delays or additional requests for information from the IRS.

Alternative forms or analogues to Form 3115 may include Form 1128: Application to Adopt, Change, or Retain a Tax Year, which may be required in certain circumstances when changing accounting methods. It's important to understand the differences between these forms and to consult with a tax advisor to determine the appropriate form to use.

To fill and submit Form 3115, taxpayers should follow the instructions provided by the IRS and include any required attachments or schedules. The completed form should be submitted to the appropriate IRS office, as indicated in the instructions. The form should be stored in a secure location for future reference and documentation purposes.