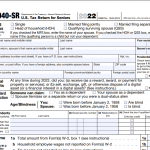

IRS Form 1040-V. Payment Voucher

Form 1040-V, also known as the Payment Voucher, is a form used by taxpayers to accompany their payments when they file their tax returns. It is not a tax return itself, but rather a voucher that is used to ensure that the payment is credited to the correct tax account.

The form consists of only one part, and the only field that must be completed is the payment amount. Other fields include the taxpayer's name, address, and Social Security Number or Taxpayer Identification Number.