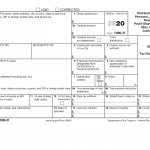

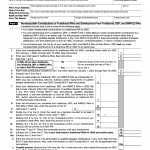

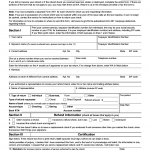

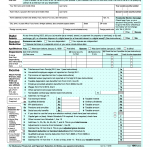

IRS Form 1040. U.S. Individual Income Tax Return

IRS Form 1040, U.S. Individual Income Tax Return, is a document used by U.S. taxpayers to report their annual income to the Internal Revenue Service (IRS). The main purpose of this form is to calculate and pay the correct amount of federal income tax owed to the government.