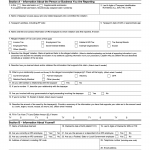

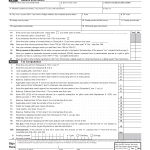

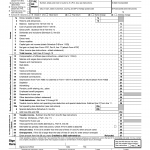

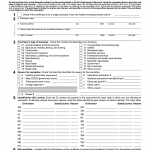

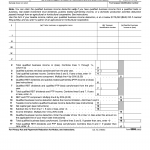

IRS Form 8995. Qualified Business Income Deduction Simplified Computation

Form 8995, Qualified Business Income Deduction Simplified Computation, is a form used by taxpayers who have qualified business income and are eligible for a deduction on their income taxes.

This form consists of several parts, including personal information about the taxpayer, details about the business income, and calculation of the deduction. Important fields to consider when compiling/filling out the form include the taxpayer's name, social security number or taxpayer identification number, and the amount of qualified business income.