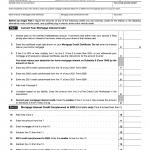

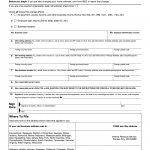

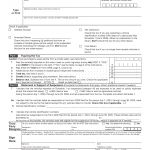

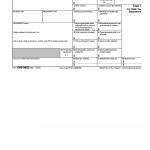

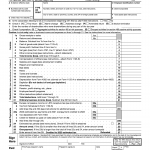

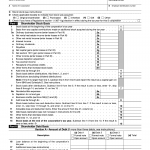

IRS Form 1099-NEC. Nonemployee Compensation

The IRS Form 1099-NEC is a tax form used to report nonemployee compensation paid to independent contractors, freelancers, and other self-employed individuals. The main purpose of the form is to provide the IRS with information about payments made to non-employees, which must be reported on their tax returns.