Customs Power of Attorney

A Customs Power of Attorney is a legal document authorizing any customs broker whose services you use in order for them to handle your customs transactions. This is true whether you are out of the country or not. You may also need to give a power of attorney to someone overseas who can then conduct business transactions in your absence. When you set up a power of attorney, make it broad enough in its language to cover the types of situations likely to arise while you are away. It should not be so broad, however, that it gives more power to that individual than you intend. Powers of attorney fall under "agency" laws, which vary from country to country. Before giving someone power of attorney in a foreign country, be sure you understand the legal ramifications.

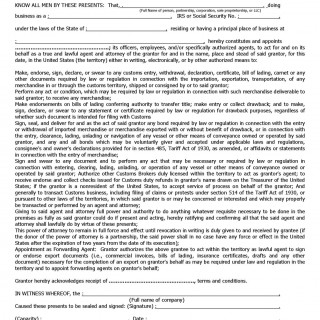

A nonresident individual, partnership, or foreign corporation may issue a power of attorney to a regular employee. Customs broker, partner, or corporation officer to act for the nonresident employer in the U.S. Any person named in a power of attorney must be a resident of the U.S. who has been authorized to accept service of process on behalf of the person or organization issuing the power of attorney. The power of attorney to accept service of process becomes irrevocable with respect to Customs transactions duly undertaken. Either Customs Form 5291 or a document using the same language as the form is acceptable. References to those acts that the issuer has not authorized his agent to perform may be deleted from the form or omitted from the document Refer to 19 CFR 141.32, "Form for power of attorney" for more information.

A power of attorney from a foreign corporation must be supported by the following documents or their equivalent when foreign law or practice differs from that in the U.S.:

- A certificate from the proper public officer of the country showing the legal existence of the corporation, unless the tact of incorporation is so generally known as to be a matter of common knowledge.

- A copy of that part of the charter or articles of incorporation that shows the scope of business of the corporation and its governing body

- A copy of the document or part thereof by which the person signing the power of attorney derives his authority, such as a provision of the charter or articles of incorporation, a copy of the resolution, minutes of the meeting of the board of directors, or other document by which the governing body conferred the authority. In this case a copy of the by laws or other document giving the governing board the authority to designate others to appoint agents or attorney is required.

A nonresident individual or partnership or a foreign corporation may issue a power of attorney to authorize the persons or firms named in the power of attorney to issue like powers of attorney to other qualified residents of the U.S. and to empower the residents to whom such powers of attorney are issued to accept service of process on be¬half of the nonresident individual or organization.

A power of attorney issued by a partnership must be limited to a period not to exceed two years from the date of execution and shall state the names of all members of the partnership One member of a partnership may execute a power of attorney for the transaction of the customs business of the partnership. When a new firm is formed by a change of membership, the power of attorney of the prior firm is no longer effective for any customs purpose. The new firm will be required to issue a power of attorney for the transaction of its custom business. All other powers of attorney may be granted for an unlimited period.

Customs Form 5291 or a document using the same language as the form is also used to empower an agent other than an attorney-at-law or Customs broker to file protests on behalf of an importer under section 514 of the Tariff Act of 1930 as amended. (See 19 CFR 141.32.)

Foreign corporations may comply with Customs regulations by executing a power of attorney on the letterhead of the corporation A nonresident individual or partner may use this same form.

Because the laws regarding incorporation, notion, and authentication of documents vary from country to country, the agent to be named in the power of attorney should consult the port director of Customs at the port of entry where proof of the document's existence may be required as to the proper form to be used and the formalities to be met.

More information on powers of attorney as they relate to the U.S. Customs Service may be found in 19 CFR 141 Subpart C, "Powers of Attorney."