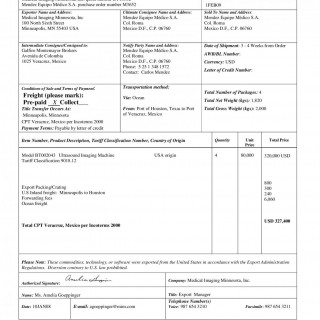

Proforma Invoice

A Proforma invoice is an invoice provided by a supplier in advance of providing the goods or service. A quotation in the form of an invoice prepared by the seller that details items which would appear on a commercial invoice if an order results.

Proforma invoices basically contain much of the same information as the formal quotation, and in many cases can be used in place of one. It should give the buyer as much information about the order as possible so arrangements can be made efficiently. The invoices inform the buyer and the appropriate import government authorities details of the future shipment; changes should not be made without the buyer’s consent.

As mentioned for the quotation, the points to be included in the proforma are:

- Seller’s name and address

- Buyer’s name and address

- Buyer’s reference

- Items quoted

- Prices of items: per unit and extended totals

- Weights and dimensions of quoted products

- Discounts, if applicable

- Terms of sale or Incoterm used (include delivery point)

- Terms of payment

- Estimated shipping date

- Validity date

When a buyer asks for a quotation the seller should always provide a pro-forma invoice. A pro-forma invoice is an invoice sent in advance of the commercial invoice, which is the final bill that the buyer agrees to pay. Some of the advantages of pro-forma invoice to the importer include to show to his government for foreign currency allocation, opening letters of credit and most importantly, to have a detailed information on the transaction that can help him plan. An accurate and professionally submitted pro forma-invoice can help buyers to make a decision and agree to the quotation.

Five key tips

- Make sure to include all the necessary information on the proforma invoice form. This includes the seller's contact information, the buyer's contact information, the description of the goods or services being sold, the quantity, the unit price, and the total amount due.

- Include the payment terms of the proforma invoice. This includes the payment method (cash, check, bank transfer, etc.), the payment due date, and any other payment-related information.

- Use the proforma invoice to set the terms of the transaction. This includes the delivery date, any applicable taxes, any applicable discounts, and any other applicable fees or charges.

- Confirm the proforma invoice details with the buyer. This includes verifying the accuracy of the information provided, ensuring that all payment terms are clear, and confirming the delivery date.

- Keep a copy of the proforma invoice for your records. This is important for tracking the transaction and making sure that all payments are received in a timely manner.