IRS Form 8821. Tax Information Authorization

Form 8821, also known as Tax Information Authorization, is an official document used by taxpayers to authorize an individual or organization to receive and inspect their confidential tax information. The main purpose of this form is to allow the authorized party to obtain important financial information about the taxpayer, such as income, deductions, and credits, for the purpose of filing taxes, responding to an IRS inquiry, or representing the taxpayer before the IRS.

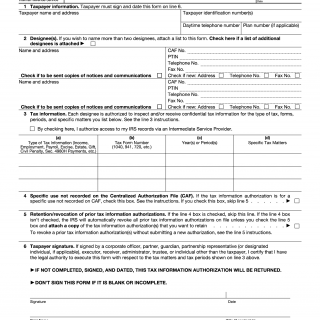

The form consists of several parts, including the taxpayer's personal information, the authorized party's information, and the types of tax information that the authorized party is allowed to receive. The important fields to consider when completing the form include the taxpayer's name, social security number, and signature, as well as the authorized party's name, address, and tax identification number.

The parties involved in this form include the taxpayer, who is authorizing the release of their confidential tax information, and the authorized party, who is receiving and inspecting the information. It is important to consider the credibility and trustworthiness of the authorized party before completing this form.

When filling out the form, the taxpayer will be required to provide their personal information, as well as the name and contact information of the authorized party. Additionally, the taxpayer must specify the types of tax information that the authorized party is allowed to receive. No additional documents are required to be attached when submitting the form.

Application examples and practice use cases of this form include situations where a taxpayer wants to authorize their accountant or tax preparer to access their confidential tax information to file their tax return, or when a taxpayer wants to authorize a third party to represent them before the IRS in a tax dispute.

Strengths of this form include the ability for taxpayers to authorize trusted parties to access their confidential tax information, which can be helpful in situations where the taxpayer is unable to handle their tax affairs on their own. Weaknesses of this form include the potential for unauthorized parties to access the taxpayer's confidential tax information if the form is not completed properly or if the authorized party is not trustworthy.

Related and alternative forms to Form 8821 include Form 2848, Power of Attorney and Declaration of Representative, which allows a taxpayer to authorize an individual to represent them before the IRS, and Form 4506-T, Request for Transcript of Tax Return, which allows a taxpayer to request a copy of their tax transcript from the IRS.

To fill and submit the form, the taxpayer must complete the necessary fields and sign the form. The form can be submitted electronically or by mail to the IRS. The IRS stores this form in their database for future reference.

In conclusion, Form 8821 is an important official document used by taxpayers to authorize an individual or organization to receive and inspect their confidential tax information. It is important to consider the parties involved and the types of tax information that the authorized party is allowed to receive when completing this form. The form can be submitted electronically or by mail, and the IRS stores it in their database for future reference.