TX HHS Form 8495. Exclusion of Host Home/Companion Care (HH/CC) Provider from the Board of Nursing (BON) Definition of Unlicensed Person

Form 8495 is a professional nursing determination used in Texas to document the exclusion of a Host Home or Companion Care (HH/CC) provider from the Board of Nursing (BON) definition of an unlicensed person.

TX HHS Form 3236. Licensed Chemical Dependency Counselor Licensure by Reciprocity Application

Form 3236 is the official application used to request a Texas Licensed Chemical Dependency Counselor (LCDC) license through reciprocity.

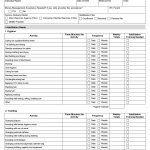

TX HHS Form 2464. Rehabilitative Services Request

Form 2464 is a Texas Health and Human Services rehabilitative services request used by nursing facilities and therapy providers to request authorization for physical, occupational, or speech therapy services for Medicaid recipients.

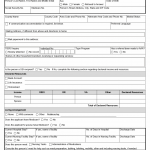

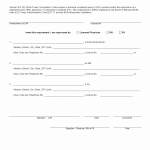

TX HHS Form 2327. Individual or Member and Provider Agreement

Form 2327 is a formal agreement used in Texas Adult Foster Care (AFC) services to document the rights, responsibilities, and financial arrangements between an individual or member and an Adult Foster Care provider.

TX HHS Form 3596. PAS/Habilitation Plan CLASS/DBMD/CFC

Form 3596 is a detailed service planning document used in Texas Medicaid waiver programs to define, authorize, and schedule Personal Assistance Services (PAS) and habilitation supports for individuals enrolled in CLASS, DBMD, and Community First Choice (CFC).

TX HHS Form 2110. Community Care Intake

Form 2110 is the official intake document used by Texas Health and Human Services Commission (HHSC) staff to begin the evaluation process for community care and long-term services.

TX HHS Form 2404. Documentation of Licensed Vocational Nurse Required Supervision

Form 2404 is an official compliance document used in the Texas Medically Dependent Children Program (MDCP) to confirm that a Licensed Vocational Nurse (LVN) is practicing under the legally required supervision of a Registered Nurse (RN), licensed physician, or physician assistant (PA).

TX HHS Form H1700-2. Individual Service Plan Addendum

Form 5502-MA is the official application used in Texas by nursing graduates and nursing students who want to obtain a Medication Aide permit through the Health and Human Services Commission (HHSC).

TX HHS Form 5502-MA. Medication Aide Application: Nursing Graduates and Nursing Students

Form 5502-MA is the official application used in Texas by nursing graduates and nursing students who want to obtain a Medication Aide permit through the Health and Human Services Commission (HHSC).

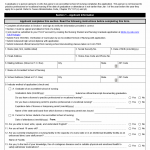

TX HHS Form H1113. Application for Prior Medicaid Coverage

Form H1113 is used in Texas to request Medicaid coverage for unpaid medical services received up to three months before the month a person applied for Medicaid.