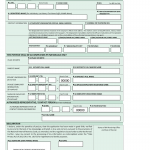

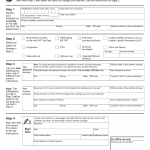

Direct Deposit Enrolment Form (PWGSC-TPSGC 8001-552E)

The Public Works and Government Services Canada (PWGSC) Direct Deposit Enrolment Form — officially titled PWGSC-TPSGC 8001-552E — is used to provide or update your banking information for government payments such as tax refunds, GST/HST credits, Canada Child Benefit, CPP, and Old Age Security.