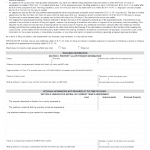

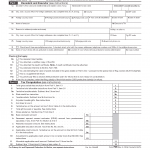

IRS Form 56. Notice Concerning Fiduciary Relationship

IRS Form 56 is a Notice Concerning Fiduciary Relationship. The main purpose of this form is to notify the Internal Revenue Service (IRS) of a fiduciary relationship between an individual or entity and a taxpayer. A fiduciary is someone who is responsible for managing the financial affairs of another person or entity.