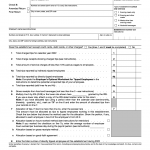

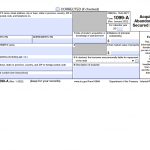

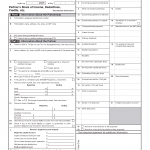

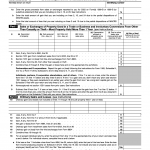

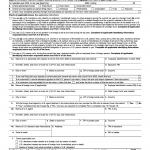

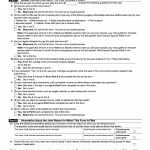

IRS Form 8379. Injured Spouse Allocation

IRS Form 8379, also known as the Injured Spouse Allocation, is used by taxpayers who file a joint tax return with their spouse but have had their portion of the refund withheld to pay their spouse's past-due debts. The main purpose of this form is to claim a portion of the joint tax refund that was offset (withheld) to pay the other spouse's debts.