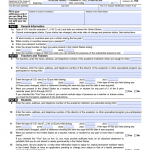

IRS Form 8843. Statement for Exempt Individuals and Individuals with a Medical Condition

The IRS Form 8843, or Statement for Exempt Individuals and Individuals with a Medical Condition, is a tax form that must be completed by certain nonresident aliens who are in the United States for a limited time. The main purpose of this form is to provide information about the individual's presence in the US and claim an exemption from certain taxes.