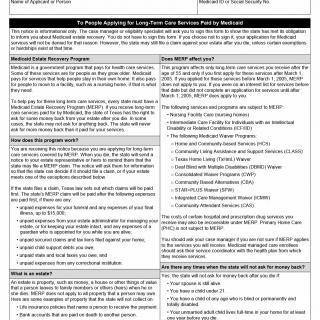

TX HHS Form 8001. Medicaid Estate Recovery Program Receipt Acknowledgement

The TX HHS Form 8001, Medicaid Estate Recovery Program Receipt Acknowledgement, is a crucial document that helps individuals applying for long-term care services paid by Medicaid understand the state's obligation to inform them about Medicaid estate recovery. This form serves as a receipt acknowledgement, confirming that the applicant has been informed of their rights and responsibilities regarding Medicaid estate recovery.

The form is used in situations where an individual is applying for long-term care services covered by the Medicaid Estate Recovery Program (MERP). It is typically filled out by applicants or their representatives. The document outlines the state's right to file a claim against the applicant's estate after they pass away, unless certain exemptions or hardships exist at that time.

The form highlights key features such as the state's obligation to inform applicants about Medicaid estate recovery and the potential for filing a claim against the estate after death. It also explains the exceptions and circumstances under which the state may not file a claim. The document is essential in ensuring transparency and understanding among applicants regarding their rights and responsibilities related to Medicaid estate recovery.

- The form is used for individuals applying for long-term care services covered by MERP.

- The state has the right to file a claim against the applicant's estate after they pass away, unless certain exemptions or hardships exist at that time.

- Exceptions include having a spouse still alive, a child of any age who is blind or permanently and totally disabled, or an unmarried adult child living full-time in your home for at least one year before you die.