IRS Form 5472. Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business

Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business, is an official document used by foreign-owned U.S. corporations or foreign corporations engaged in a U.S. trade or business to report their transactions with related parties.

The main purpose of this form is to provide the Internal Revenue Service (IRS) with information about the transactions between the foreign-owned U.S. corporation or foreign corporation and its related parties, which include other corporations, partnerships, trusts, and individuals. The form helps the IRS to monitor international transactions and ensure that the foreign-owned U.S. corporation or foreign corporation is complying with U.S. tax laws.

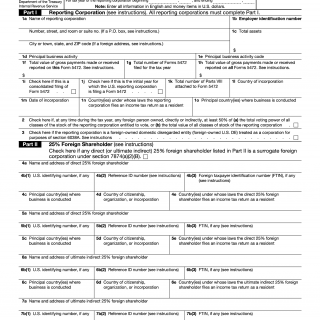

The form consists of several parts, including the identification of the foreign-owned U.S. corporation or foreign corporation, information about the related parties, and details of the transactions between the parties. The important fields to consider when completing the form include the name and identification number of the foreign-owned U.S. corporation or foreign corporation, as well as the names, identification numbers, and relationship to the foreign-owned U.S. corporation or foreign corporation of the related parties.

The parties involved in this form include the foreign-owned U.S. corporation or foreign corporation and its related parties. It is important to consider the relationships between the parties and the nature of the transactions when completing this form.

When filling out the form, data required includes the taxpayer identification number (TIN) of the foreign-owned U.S. corporation or foreign corporation, as well as the TINs of the related parties. Additionally, the form requires details of the transactions between the parties, including the type of transaction, the amount, and the method of valuation. No additional documents are required to be attached when submitting the form.

Application examples and practice use cases of this form include situations where a foreign-owned U.S. corporation or foreign corporation engages in transactions with related parties, such as the purchase or sale of goods, services, or intellectual property. The form is also used to report any loans or financial transactions between the parties.

Strengths of this form include the ability for the IRS to monitor international transactions and ensure compliance with U.S. tax laws. Weaknesses of this form include the potential for confusion and errors when completing the form, as well as the possibility of penalties for non-compliance.

Related and alternative forms to Form 5472 include Form 1120-F, U.S. Income Tax Return of a Foreign Corporation, which is used to report the income of a foreign corporation that is engaged in a U.S. trade or business, and Form 8865, Return of U.S. Persons With Respect to Certain Foreign Partnerships, which is used to report the activities of a U.S. person in a foreign partnership.

To fill and submit the form, the taxpayer must complete the necessary fields and sign the form. The form can be submitted electronically or by mail to the IRS. The IRS stores this form in their database for future reference.

In conclusion, Form 5472 is an important official document used by foreign-owned U.S. corporations or foreign corporations engaged in a U.S. trade or business to report their transactions with related parties. It is important to consider the parties involved and the nature of the transactions when completing this form. The form can be submitted electronically or by mail, and the IRS stores it in their database for future reference.