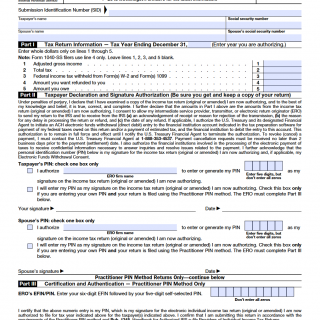

IRS Form 8879. IRS e-file Signature Authorization

Form 8879, also known as the IRS e-file Signature Authorization, is a document used to authorize an electronic signature for an electronically filed tax return. The main purpose of the form is to provide consent for tax preparers to e-file a taxpayer's return on their behalf.

The form consists of several important fields, including the taxpayer's personal information, the tax year and type of return being filed, and the preparer's information. The taxpayer must sign and date the form, providing their consent for the tax preparer to e-file their return.

The parties involved in the process are the taxpayer and the tax preparer, who will use the form to e-file the tax return. It is important to consider the accuracy of the information provided on the form, as any errors could result in delays or penalties.

To fill out the form, the taxpayer must provide their personal information, such as their name, social security number, and address, as well as the tax year and type of return being filed. The preparer's information, including their name, address, and Electronic Filing Identification Number (EFIN), must also be provided.

In addition to the completed form, the taxpayer must attach a copy of their electronic filing instructions or a copy of their e-file authorization document. These documents will be used to verify the taxpayer's identity and ensure the accuracy of the e-filed return.

Strengths of the form include the ability to securely and efficiently file tax returns electronically, while weaknesses may include the potential for errors or fraud. It is important to carefully review the completed form and supporting documents to ensure accuracy and prevent fraudulent activity.

Alternative forms that may be used in certain circumstances include Form 8878 for IRS e-file Signature Authorization for Form 4868 or Form 2350, or Form 8453-EX for Electronic Filing Declaration for Excise Tax Returns. These forms may be used for specific tax situations and should be carefully reviewed to ensure accuracy.

To submit the form, the taxpayer must sign and date the completed form and provide it to their tax preparer. The preparer will then use the authorization to e-file the taxpayer's return. The form will be stored electronically by the preparer and the IRS for record-keeping purposes.