IRS Letter 4883C. Potential Identity Theft During Original Processing

IRS Letter 4883C is an official notice sent by the Internal Revenue Service to request identity verification from a taxpayer before continuing the processing of a tax return. This letter is issued when the IRS detects a potential risk of identity theft or cannot confidently confirm that the tax return was filed by the rightful taxpayer.

Purpose of IRS Letter 4883C

The primary purpose of Letter 4883C is to protect taxpayers and the tax system from identity theft and fraudulent filings. When the IRS identifies indicators that a return may involve unauthorized use of a Social Security number, it temporarily pauses processing and asks the taxpayer to verify their identity.

When IRS Letter 4883C Is Sent

This letter is typically sent after a tax return has been submitted but before it is fully processed. It does not indicate that fraud has been confirmed. Instead, it reflects that additional verification is required to ensure the return belongs to the correct individual.

How IRS Letter 4883C Fits Into the Tax Processing System

Letter 4883C is part of the IRS identity verification workflow. Until the requested verification is completed, the IRS will not finalize the tax return or issue any associated refund. Once identity verification is successful, processing resumes according to standard IRS procedures.

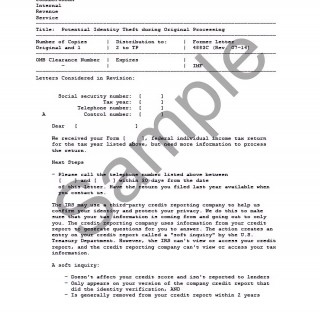

What the Letter Contains

IRS Letter 4883C explains why identity verification is needed and outlines the methods available to complete that verification. The letter itself does not function as a form to be filled out and returned, but rather as a notice initiating a verification process.

Official Status and Source

IRS Letter 4883C is an official communication issued by the Internal Revenue Service. It is governed by IRS identity protection policies and is used nationwide as part of federal tax administration.

Practical Guidance

This page provides an official overview of IRS Letter 4883C and its role within the tax system. For a practical, step-by-step explanation of what to do if you receive this letter, how identity verification works, and what happens next, see the detailed guidance below.