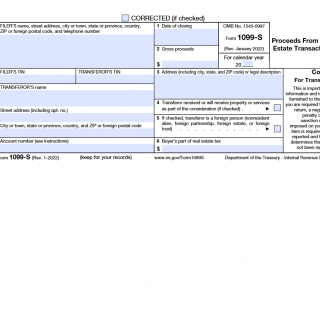

IRS Form 1099-S. Proceeds from Real Estate Transactions

Form 1099-S, also known as Proceeds from Real Estate Transactions, is a tax form used to report proceeds from real estate transactions. The main purpose of the form is to report the sale or exchange of real estate property, such as land or a house.

The form consists of several important fields, including the seller's personal and contact information, the buyer's personal and contact information, the property address, and the proceeds from the sale. The parties involved in the process are the buyer and seller, as well as the Internal Revenue Service (IRS), who will use the form to ensure that the appropriate taxes are paid on the proceeds from the sale.

It is important to consider the accuracy of the information provided on the form, as any errors could result in penalties or delays. To fill out the form, the seller must provide their personal information, such as their name, social security number, and address, as well as the buyer's information and the property address. The proceeds from the sale must also be reported on the form.

In addition to the completed form, the seller must attach a copy of the closing statement, which provides a detailed breakdown of the costs associated with the sale. This document will be used to verify the accuracy of the information provided on the form.

Strengths of the form include the ability to accurately report real estate transactions and ensure that the appropriate taxes are paid, while weaknesses may include the potential for errors or delays. It is important to carefully review the completed form and supporting documents to ensure accuracy and prevent fraudulent activity.

Alternative forms that may be used in certain circumstances include Form 1099-MISC for reporting income from non-employee compensation or Form 1099-DIV for reporting dividends and distributions. These forms may be used for specific tax situations and should be carefully reviewed to ensure accuracy.

To submit the form, the seller must provide a copy to the buyer and file a copy with the IRS. The form will be stored electronically by the IRS for record-keeping purposes.