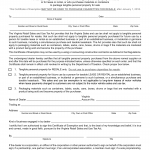

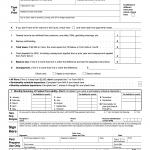

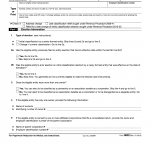

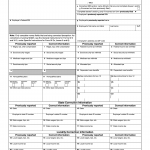

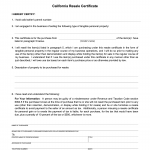

Form CDTFA-230. General Resale Certificate (California)

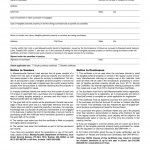

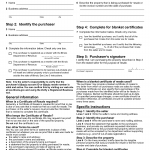

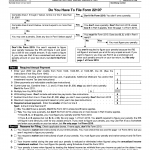

CDTFA-230, also known as the General Resale Certificate, is a document used by purchasers in California who are engaged in the business of selling tangible personal property. The main purpose of the form is to allow purchasers to issue resale certificates when purchasing items they will sell in the regular course of their business operations, which exempts the seller from owing tax on that sale.