IRS Form 3911. Taxpayer Statement Regarding Refund

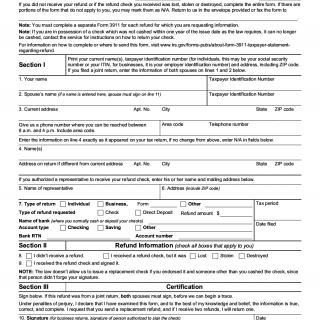

IRS Form 3911, Taxpayer Statement Regarding Refund, is a form that taxpayers can use to inquire about the status of their refund or request a replacement for a lost, stolen, or destroyed refund check. The form consists of one part and important fields include the taxpayer's full name, social security number or taxpayer identification number, tax year, type of return, refund amount, and reason for the request.

The parties involved in this form are the taxpayer and the IRS. It is important to consider that taxpayers should only submit this form if they have not received their refund within 28 days of filing their tax return electronically, or within 6 weeks of filing their paper tax return. Additionally, taxpayers should ensure that they have not already cashed their refund check before submitting this form.

When filling out this form, taxpayers will be required to provide their personal information, tax return information, and details about their refund. They may also need to attach additional documentation, such as a copy of their tax return or a voided check, depending on the reason for the request.

An example of a use case for this form is if a taxpayer filed their tax return and is expecting a refund, but has not received it within the expected time frame. They can use Form 3911 to inquire about the status of their refund or request a replacement check if their original refund check was lost, stolen, or destroyed.

Strengths of this form include its simplicity and ease of use, as well as its effectiveness in resolving issues related to missing or lost refund checks. However, a weakness of this form is that it may take some time for the IRS to process the request and issue a replacement refund check.

Related forms include Form 4506, Request for Copy of Tax Return, and Form 4506-T, Request for Transcript of Tax Return. An alternative form is Form 14039, Identity Theft Affidavit, which taxpayers can use to report suspected identity theft related to their tax return.

To fill and submit this form, taxpayers should follow the instructions provided on the form itself and ensure that they include all required information and documentation. The completed form can be submitted by mail or fax to the appropriate IRS office, as indicated on the form. Taxpayers should keep a copy of the form for their records.

Mailing addresses and fax numbers for form 3911

- Maine, Maryland, Massachusetts, New Hampshire, Vermont: Andover Refund Inquiry Unit, 310 Lowell St, Mail Stop 666, Andover, MA 01810, 855-253-3175

- Georgia, Iowa, Kansas, Kentucky, Virginia: Atlanta Refund Inquiry Unit, 4800 Buford Hwy, Mail Stop 112, Chamblee, GA 30341, 855-275-8620

- Florida, Louisiana, Mississippi, Oklahoma, Texas: Austin Refund Inquiry Unit, 3651 S Interregional Hwy 35, Mail Stop 6542 AUSC, Austin, TX 78741, 855-203-7538

- New York: Brookhaven Refund Inquiry Unit, 1040 Waverly Ave, Mail Stop 547, Holtsville, NY 11742, 855-297-7736

- Alaska, Arizona, California, Colorado, Hawaii, Nevada, New Mexico, Oregon, Utah, Washington, Wisconsin, Wyoming: Fresno Refund Inquiry Unit, 3211 S Northpointe Dr, Mail Stop B2007, Fresno, CA 93725, 855-332-3068

- Arkansas, Connecticut, Delaware, Indiana, Michigan, Minnesota, Missouri, Montana, Nebraska, New Jersey, Ohio, West Virginia: Kansas City Refund Inquiry Unit, 333 W Pershing Rd, Mail Stop 6800, N-2, Kansas City, MO 64108, 855-344-9993

- Alabama, North Carolina, North Dakota, South Carolina, South Dakota, Tennessee: Memphis Refund Inquiry Unit, 5333 Getwell Rd, Mail Stop 8422, Memphis, TN 38118, 855-580-4749

- District of Columbia, Idaho, Illinois, Pennsylvania, Rhode Island: Philadelphia Refund Inquiry Unit, 2970 Market St, DP 3-L08-151, Philadelphia, PA 19104, 855-404-9091

- A foreign country, U.S. possession or territory, or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien: Austin Refund Inquiry Unit, 3651 S Interregional Hwy 35, Mail Stop 6542 AUSC, Austin, TX 78741, 855-203-7538

- For Business Entities: States west of the Mississippi should submit authorizations to Ogden; states east of the Mississippi should submit authorizations to Cincinnati. The exceptions are Arkansas and Louisiana submit authorizations to Cincinnati. Wisconsin authorizations are submitted to Ogden.

- Cincinnati Refund Inquiry Unit, PO Box 145500, Mail Stop 536G, Cincinnati, OH 45250, 855-307-3124

- Ogden Refund Inquiry Unit, 1973 N Rulon White Blvd, Mail Stop 6733, Ogden, UT 84404, 855-578-2550