Credit Note

A credit note is a document used in business transactions in which an issuer, such as a vendor or seller, authorizes a credit against their accounts receivable balance to a buyer, typically for items that have been returned or overcharged. It can also be used to adjust an invoice or correct an error.

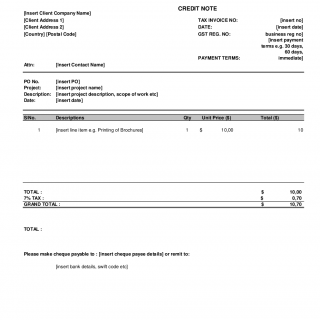

The document typically includes the name and address of the issuer and the recipient, a unique identification number, the date, and details of the credit, such as the reason for the credit and the amount. The credit note may also include any terms and conditions or instructions for the recipient to follow, such as how to apply the credit to future invoices or obtain a refund.

Credit notes are important for keeping accurate records and maintaining good customer relationships. They provide proof of the correction or adjustment, document the reason for the credit and can be used in case of disputes. A credit note can also help to maintain the vendor or seller's reputation for quality customer service.

When compiling a credit note, the data required includes the name and address of both the issuer and the recipient, the unique identification number, the date and details of the transaction, and any terms and conditions or instructions. The issuer may also need to attach supporting documents such as a return authorization or invoice.

Related forms include debit notes, invoices, and receipts. Debit notes are the opposite of credit notes, they are documents used to adjust the customer's account that increases the accounts receivable balance. Invoices and receipts are used to document sales and payments

The benefits of using a credit note include maintaining accurate records, reducing disputes, and preserving customer relationships. The challenges and risks include errors in documentation, confusion over terms and conditions, and the potential for fraud or abuse.

Once a credit note is complete, it should be submitted to the recipient in a timely manner, either in person or via mail or email. The form can be stored electronically or in a physical file for future reference.