IRS Form 8802. Application for U.S. Residency Certification

Form 8802, Application for U.S. Residency Certification, is a form used by individuals to request certification of their U.S. residency status for tax purposes. The main purpose of this form is to help individuals claim tax treaty benefits and avoid double taxation on income earned in foreign countries.

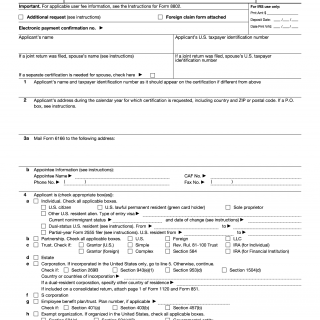

The form consists of several parts, including a general information section, a section for requesting certification of residency status, and a section for providing additional information. Important fields to consider when completing the form include the applicant's name, address, and taxpayer identification number (TIN). The form must be signed and dated by the applicant.

The parties involved in the form are the applicant and the IRS. When filling out the form, the applicant will need to provide personal information such as their name, address, and TIN. Additionally, the applicant may need to attach supporting documentation, such as a copy of their passport or visa.

Strengths of this form include its ability to help individuals claim tax treaty benefits and avoid double taxation, while weaknesses may include the complexity of the form and the potential for errors in completing it. Opportunities include the ability to save money on taxes, while threats may include the potential for the IRS to deny the application or impose penalties for incorrect or incomplete information.

Related forms include Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting, which is used by foreign individuals to claim tax treaty benefits, and Form W-9, Request for Taxpayer Identification Number and Certification, which is used by U.S. individuals to provide their TIN to payers of income.

To fill and submit the form, the applicant will need to gather the necessary information and documentation and complete the form accurately. The form can be submitted online or by mail to the IRS. The form will be stored by the IRS for record-keeping purposes.

Examples of use cases for Form 8802 include U.S. citizens or residents living abroad who need to claim tax treaty benefits, foreign individuals who need to prove their U.S. residency status, and individuals who need to establish their residency status for other tax-related purposes.