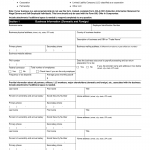

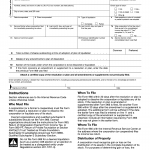

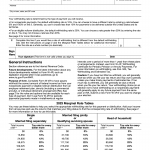

IRS Form 8300. Report of Cash Payments Over $10,000 Received In a Trade or Business

IRS Form 8300 is a report used to disclose cash payments received over $10,000 in a trade or business. The primary purpose of this form is to prevent money laundering and tax evasion by tracking large cash transactions.