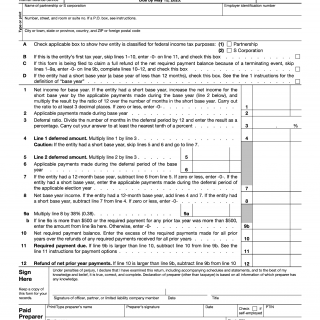

IRS Form 8752. Required Payment or Refund Under Section 7519

Form 8752, Required Payment or Refund Under Section 7519, is a tax form used by partnerships to report required payments or refunds related to the disposition of partnership interests. The form is officially known as "Form 8752, Required Payment or Refund Under Section 7519."

The main purpose of this form is to report the payment or refund of tax that is required to be made under Section 7519 of the Internal Revenue Code. This section requires partnerships to pay tax on certain dispositions of partnership interests. The form consists of several parts, including identifying information about the partnership, the calculation of the required payment or refund, and any additional information that may be necessary to complete the form.

Partnerships are the parties involved in this form. When completing the form, it is important to consider the correct calculation of the required payment or refund, as well as any additional information that may be necessary to complete the form accurately. The data required when filling the form includes the partnership's identifying information, the calculation of the required payment or refund, and any additional information that may be necessary to complete the form.

When completing Form 8752, it is important to attach any supporting documentation that may be necessary to support the calculation of the required payment or refund. This may include copies of partnership agreements, transfer documents, or other relevant documents.

An example of a practical use case for Form 8752 is when a partnership sells or transfers a partnership interest. In this case, the partnership may be required to pay tax on the gain from the sale or transfer. The form is also used to report any refunds of tax that may be due to the partnership.

Strengths of this form include its ability to accurately report required payments or refunds related to the disposition of partnership interests. Weaknesses may include the complexity of the form and the potential for errors when completing it. Opportunities related to this form may include the ability to reduce tax liability through careful planning, while threats may include the potential for penalties or fines for incorrect or incomplete reporting.

Related forms include Form 1065, U.S. Return of Partnership Income, and Form 8949, Sales and Other Dispositions of Capital Assets. These forms may be used in conjunction with Form 8752 to accurately report the disposition of partnership interests.

To fill out and submit Form 8752, partnerships must provide accurate information about the required payment or refund, as well as any supporting documentation that may be necessary to support the calculation. The form should be submitted to the Internal Revenue Service (IRS) along with any required payments or refunds. The form should be stored for future reference in case of any future tax audits or disputes.