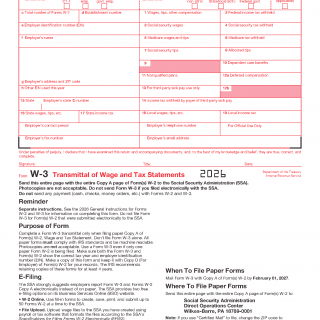

IRS Form W-3. Transmittal of Wage and Tax Statements

Form W-3, Transmittal of Wage and Tax Statements, is a tax form used by employers to transmit employee wage and tax information to the Social Security Administration (SSA). This form is a summary of all the W-2 forms issued to employees and is required to be filed annually.

The form consists of several parts, including the employer's name, address, and identification number, the total number of W-2 forms issued, the total amount of wages paid, and the total amount of taxes withheld. The important fields to consider when compiling this form are the employer's identification number and the total amount of wages paid and taxes withheld.

The parties involved in this communication are the employer and the SSA. The data required to complete this form includes the employer's identification number, the total number of W-2 forms issued, the total amount of wages paid, and the total amount of taxes withheld. No additional documents are required to accompany this form.

Application examples and use cases for this form include employers filing this form annually to transmit employee wage and tax information to the SSA. The strength of this form is that it ensures compliance with federal tax laws and regulations. The weakness is that incorrect or incomplete information can result in penalties and fines.

There are related forms, such as Form W-2, Wage and Tax Statement, which is issued to employees to report their wages and taxes withheld. An analogue of this form is the Form 1096, Annual Summary and Transmittal of U.S. Information Returns, which is used to transmit various types of tax forms to the IRS. The difference between these forms is the type of information being transmitted.

The future of the participants is affected by this form, as it ensures accurate reporting of employee wage and tax information, which affects their Social Security benefits and tax obligations. This form is submitted to the SSA annually, along with the W-2 forms. The form is stored by the SSA and is used to verify the accuracy of employee wage and tax information.