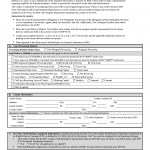

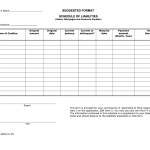

SBA Form 2202. Schedule of Liabilities

SBA Form 2202, also known as Schedule of Liabilities, is a document required by the U.S. Small Business Administration (SBA) for businesses seeking financial assistance through the SBA loan program. The purpose of the form is to provide a detailed list of the borrower's current liabilities, including the name of the creditor, the type of debt, the amount owed, and the payment terms.