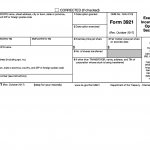

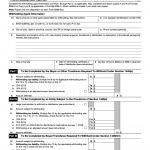

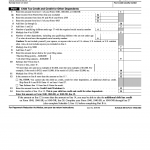

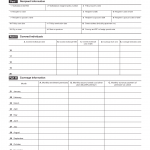

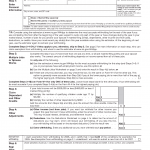

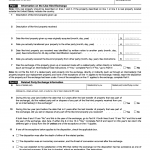

IRS Form 8824. Like-Kind Exchanges

IRS Form 8824 is an important form used in the United States for reporting like-kind exchanges. In this article, we will provide a detailed description of the form, including its purpose, important parts, fields, parties involved, features to consider when compiling, advantages, potential problems, related forms, and where and how the form is submitted and stored.