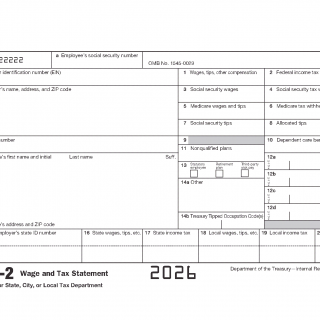

IRS Form W-2. Wage and Tax Statement

IRS Form W-2, also known as the Wage and Tax Statement, is a critical form used in the United States tax system. It is used by employers to report annual wages and taxes withheld from employees' paychecks to the IRS and the Social Security Administration (SSA). Employees use the information on the W-2 form to complete their individual income tax returns.

The form consists of several parts:

- Employee's personal information, including name, address, and Social Security Number (SSN).

- Employer's information, such as the Employer Identification Number (EIN) and address.

- Fields for reporting various wages, tips, and other compensations.

- Fields for reporting both state and federal taxes withheld.

- Any additional information relevant to the employee's compensation and taxes.

The most important fields on the W-2 form are:

- Box 1: Wages, tips, and other compensation (the total income the employee received throughout the year)

- Box 2: Federal income tax withheld

- Box 3: Social Security wages

- Box 4: Social Security tax withheld

- Box 5: Medicare wages and tips

- Box 6: Medicare tax withheld

- Boxes 15-17: State tax details

The W-2 form is compiled by employers and sent to employees, the IRS, and the SSA. Employers are typically required to provide employees with a copy of their W-2 by January 31 of each year for the previous tax year.

When compiling the form, it is essential to use accurate information from payroll records, employee information, and tax withholding data.

The advantages of the W-2 form include its widespread use and acceptance, clear instructions, and well-defined categories for reporting income and tax withheld. Completion of the form ensures employee's earnings and contributions are correctly reported to the government.

Problems that may arise when filling out the form can include incorrect or missing information, typographical errors, or improper categorization of wages and other compensation.

Related forms include:

- Form W-3: Transmittal of Wage and Tax Statements, which is a summary of all W-2 forms the employer is submitting to the SSA.

- Form W-2c: Corrected Wage and Tax Statement, which is used to rectify errors in the original W-2 form.

Employers are required to submit W-2 forms electronically or by mail to the SSA, while employees typically attach a copy of their W-2 to their individual tax return. Copies of the W-2 forms are retained by the employer, the employee, the IRS, and the SSA for various periods.

Please note that this information provided is for general informational purposes only and should not be considered professional advice. Always consult with a tax professional for advice on your specific situation.