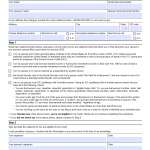

IRS Form 4684. Casualties and Thefts

IRS Form 4684 is used to report losses due to casualties and thefts that are not covered by insurance or other means of reimbursement. The form consists of three parts:

Part I: Calculation of Losses - This section is used to calculate the amount of the loss and to determine the deductible amount.

Part II: Gains and Reimbursements - This section is used to report any gains or reimbursements received as a result of the loss.

Part III: Explanation of Casualty or Theft - This section is used to provide a detailed explanation of the circumstances surrounding the loss.