IRS Form 8824. Like-Kind Exchanges

IRS Form 8824 is an important form used in the United States for reporting like-kind exchanges. In this article, we will provide a detailed description of the form, including its purpose, important parts, fields, parties involved, features to consider when compiling, advantages, potential problems, related forms, and where and how the form is submitted and stored.

IRS Form 8824 is used to report like-kind exchanges of property, which are exchanges of real or personal property that are held for investment, productive use in trade, or business. The form is used to calculate the gain or loss on a like-kind exchange, which is the difference between the adjusted basis of the property given up and the fair market value of the property received.

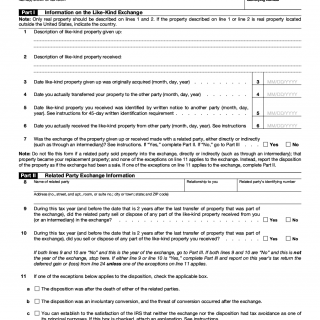

IRS Form 8824 consists of two parts:

- Part I: Information on the Like-Kind Exchange

- Part II: Analysis of Section 1231 Gain or Loss Resulting from the Exchange

The most important fields on IRS Form 8824 are:

- Part I: Information on the Like-Kind Exchange

- Line 1: Date of transfer of the property given up

- Line 2: Date of acquisition of the replacement property

- Line 3: Description of the property given up

- Line 4: Description of the replacement property

- Line 6: Amount realized on the transfer of the property given up

- Line 7: Adjusted basis of the property given up

- Line 8: Gain or loss on the exchange

- Part II: Analysis of Section 1231 Gain or Loss Resulting from the Exchange

IRS Form 8824 is used in cases where a taxpayer has exchanged property that is held for investment, productive use in trade, or business. The parties involved in the document are the taxpayer who is reporting the exchange and any other parties involved in the exchange.

When compiling IRS Form 8824, it is important to consider the following features:

- The dates of the transfer of the property given up and the acquisition of the replacement property

- The descriptions of the property given up and the replacement property

- The amount realized on the transfer of the property given up

- The adjusted basis of the property given up

- The gain or loss on the exchange

The advantages of using IRS Form 8824 include:

- It allows taxpayers to defer the recognition of gain or loss on like-kind exchanges

- It provides a clear method for calculating the gain or loss on a like-kind exchange

- It can help taxpayers reduce their tax liability by deferring the recognition of gain or loss

Some potential problems that can arise when filling out IRS Form 8824 include:

- Incorrect calculations of the gain or loss on the exchange

- Incorrect reporting of the dates of the transfer and acquisition

- Incorrect descriptions of the property given up and the replacement property

Related forms to IRS Form 8824 include:

- Form 4797: Sales of Business Property

- Form 6252: Installment Sale Income

Alternative forms to IRS Form 8824 include:

- Form 8949: Sales and Other Dispositions of Capital Assets

- Schedule D: Capital Gains and Losses

IRS Form 8824 is unique in that it is used specifically for reporting like-kind exchanges. Other forms, such as Form 8949 and Schedule D, are used for reporting capital gains and losses on the sale of property.

IRS Form 8824 is submitted to the IRS along with the taxpayer's tax return. The form can be submitted electronically or by mail. Copies of the form should be retained for the taxpayer's records.