IRS Form 8288. U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons

IRS Form 8288 is a U.S. Withholding Tax Return for Certain Dispositions by Foreign Persons. The main purpose of this form is to report and pay any tax owed on the disposition of U.S. real property interests by foreign persons, as required by the Foreign Investment in Real Property Tax Act (FIRPTA).

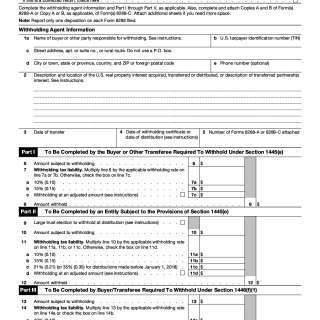

The form consists of several important fields, including the foreign person's personal and contact information, the details of the disposition of the U.S. real property interests, and the amount of tax owed. It is important to carefully complete all fields and attach any relevant supporting documentation, such as copies of the purchase agreement or settlement statement.

The parties involved in the form are the foreign person who disposed of the U.S. real property interests and the Internal Revenue Service (IRS). It is important to note that the withholding tax must be paid at the time of the disposition, and failure to do so may result in penalties and interest.

Strengths of Form 8288 include its clear instructions and straightforward format, while weaknesses may include the potential complexity of the tax calculation and the need for additional documentation. Opportunities for improvement may include the incorporation of online submission options and increased accessibility for non-English speakers. Threats to the use of the form may include changes in tax laws or regulations that render the form obsolete.

Related forms may include Form 8288-A, which is used to apply for a withholding certificate to reduce or eliminate the withholding tax, and Form 1040NR, which is used to report U.S. income tax returns for nonresident aliens. It is important to carefully review the instructions for each form before submitting to ensure compliance with the appropriate procedures.

To fill and submit Form 8288, the foreign person must complete all required fields and attach any supporting documentation. The form must be submitted to the IRS within 20 days of the disposition of the U.S. real property interests. A copy of the form should be retained for the foreign person's records. The form can be stored electronically or in paper form.