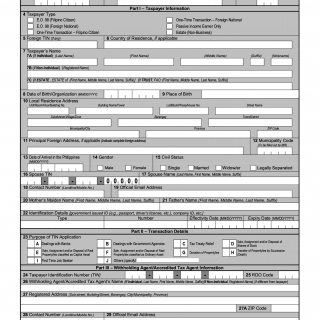

BIR Form 1904. Application for Registration For Taxpayer and Person Registering under E.O. 98 (Securing a TIN to be able to transact with any Government Office) and Others

BIR Form No. 1904, issued by the Bureau of Internal Revenue (BIR) in the Republic of the Philippines, is an essential document for individuals and entities seeking to register for a Taxpayer Identification Number (TIN) under various circumstances. This form facilitates the registration process and is crucial for compliance with tax and government regulations.

Key Sections and Information:

Part I – Taxpayer Information:

- Date of Registration: Enter the date of registration in MM/DD/YYYY format.

- PhilSys Card Number (PCN): If applicable, provide the Philippine Identification System (PhilSys) Card Number.

- RDO Code: The Revenue District Office (RDO) Code is filled out by the BIR.

- Taxpayer Type: Check the appropriate box that best describes your taxpayer type, including Filipino Citizen under E.O. 98, Foreign National under E.O. 98, and others.

- Foreign TIN: If you have a foreign Taxpayer Identification Number, enter it here.

- Country of Residence: If applicable, specify your country of residence.

- Taxpayer's Name: Enter your complete name or registered name. Include nicknames, suffixes, and other relevant details as needed.

- Date of Birth/Organization: Provide your date of birth (if an individual) or the date of organization (for non-individuals).

- Place of Birth: Indicate your place of birth.

- Local Residence Address: Provide your local residence address, including unit/floor/building number, street name, barangay, town/district, municipality/city, province, and ZIP code.

- Principal Foreign Address: If applicable, provide your complete foreign address.

- Municipality Code: The municipality code is filled out by the BIR.

- Date of Arrival in the Philippines: For foreign nationals, enter your date of arrival in the Philippines.

- Gender: Indicate your gender as male or female.

- Civil Status: Specify your civil status, such as single, married, widow/er, or legally separated.

- Spouse TIN: If married, provide your spouse's TIN.

- Spouse Name: For married individuals, include your spouse's last name, first name, middle name, and suffix.

- Contact Number: Enter your contact number, which can be a landline or mobile number.

- Official Email Address: Provide your official email address.

- Mother's Maiden Name: Include your mother's maiden name, including first name, middle name, last name, and suffix.

- Father's Name: Provide your father's name, including first name, middle name, last name, and suffix.

- Identification Details: Enter details of any government-issued ID or company ID, including type, number, effectivity date, and expiry date.

Part II – Transaction Details: 23. Purpose of TIN Application: Select the purpose of your TIN application from the list provided.

Part III – Withholding Agent/Accredited Tax Agent Information: 24. Taxpayer Identification Number (TIN): Enter your TIN, if applicable.

- RDO Code: The RDO code is filled out by the BIR.

- Withholding Agent/Accredited Tax Agent's Name: If your authorized representative is different from the taxpayer, provide their name.

- Registered Address: Specify the registered address of the authorized representative.

- Contact Number: Enter the contact number of the authorized representative.

- Official Email Address: Provide the official email address of the authorized representative.

Part IV – Declaration and Signature:

- The taxpayer or authorized representative must sign and date the form, declaring that the application is made in good faith and is true and correct to the best of their knowledge and belief, in accordance with tax laws and regulations.

Documentary Requirements: The form includes a section specifying the documentary requirements needed based on the purpose of the TIN application and the taxpayer's category, whether an individual or non-individual.

Important Note: Possession of more than one Taxpayer Identification Number (TIN) is criminally punishable under the National Internal Revenue Code of 1997, as amended. Compliance with this requirement is crucial to ensure accurate and lawful taxation in the Philippines.

Privacy and Data Protection: The form also mentions the Data Privacy Act of 2012 (R.A. No. 10173) and gives consent for the processing of the applicant's information for legitimate and lawful purposes.

BIR Form No. 1904 is a critical document for individuals and entities in the Philippines to establish their tax identity and meet their tax obligations as per the country's tax laws and regulations.