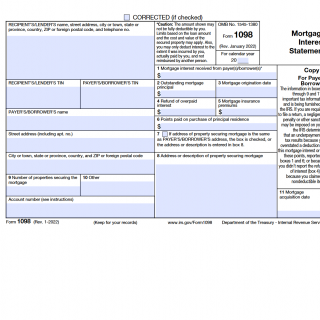

IRS Form 1098. Mortgage Interest Statement

IRS Form 1098, Mortgage Interest Statement, is a tax form used by mortgage lenders to report the amount of interest paid on a mortgage during the tax year. This form is important for taxpayers who want to claim a deduction for mortgage interest on their tax return.

The form consists of several parts, including the borrower's information, the lender's information, and details about the mortgage. Important fields include the borrower's name, address, and taxpayer identification number (TIN), as well as the lender's name, address, and TIN. Additionally, the form requires information about the mortgage, such as the amount of interest paid during the tax year and the outstanding balance of the mortgage.

When completing the form, it is important to consider the parties involved and ensure that all information is accurate and complete. Taxpayers will need to provide documentation to support any claims made on the form, such as a copy of the mortgage statement.

Examples of use cases for Form 1098 include a homeowner paying interest on a mortgage for their primary residence, a real estate investor paying interest on a mortgage for a rental property, or a borrower refinancing their mortgage and paying interest on the new loan.

Strengths of the form include its ability to accurately report mortgage interest paid, which can help taxpayers claim a deduction on their tax return. Weaknesses may include the complexity of the form and the need for supporting documentation.

Related forms include IRS Form 1099-INT, which reports interest income earned on investments, and IRS Form 1098-C, which reports contributions of motor vehicles, boats, and airplanes to charitable organizations. Analogues to this form may include state-specific mortgage interest statements.

To fill and submit the form, lenders can either use paper forms or file electronically through the IRS website. The completed form should be sent to the borrower and a copy should be provided to the IRS. The form should be stored for at least three years.

In conclusion, IRS Form 1098 is a tax form used to report the amount of mortgage interest paid during the tax year to the IRS. It consists of several parts, requires important information about the parties involved and the mortgage, and requires supporting documentation. It is important to ensure accuracy and completeness when completing the form, and to consider related forms and filing requirements.