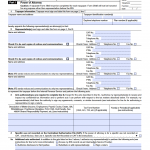

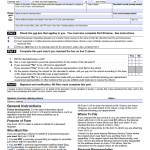

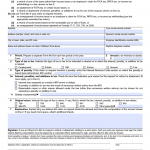

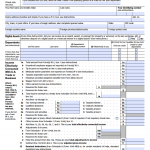

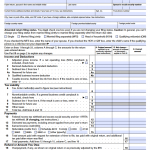

IRS Form 1444

IRS Form 1444, titled "Your Economic Impact Payment," is a document that confirms an individual's receipt of their stimulus payment. The form is sent by the IRS to individuals who received a stimulus payment via direct deposit or a paper check in the mail. The form consists of four parts: Taxpayer Information, Payment Information, Certification, and Contact Information.