IRS Form 8962. Premium Tax Credit (PTC)

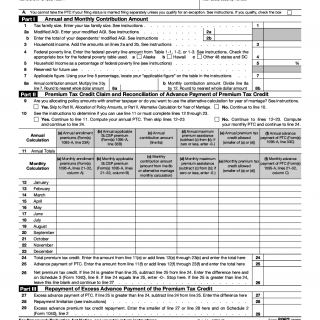

The IRS Form 8962 is an IRS form used to claim the Premium Tax Credit (PTC). This form is used by individuals who purchased health insurance through the Health Insurance Marketplace and are eligible for the PTC. In order to claim the PTC, you must complete Form 8962 and file it with your federal tax return.

To complete Form 8962, you must provide information about your household, your health insurance coverage, and the amount of your expected premium tax credit. You must also provide information about any advance payments of the premium tax credit that you received during the tax year. Once the form is completed, it must be filed with the IRS.

To submit Form 8962 to the IRS, you must send it along with your federal tax return. You can submit the form either electronically or by mail. For electronic filing, you can use e-file or the IRS Free File program. If you are filing by mail, you can mail your return to the address provided on the instructions for the form.

Examples of When to Use IRS Form 8962 for Calculating the Premium Tax Credit

IRS Form 8962 is a tax form used in the United States for calculating the premium tax credit (PTC) that individuals and families may be eligible for if they purchased health insurance through the Health Insurance Marketplace. Here are some examples of when this form may be used:

- A married couple with two children purchased health insurance through the Health Insurance Marketplace and received advance payments of the premium tax credit to help pay for their monthly insurance premiums. At the end of the year, they must use Form 8962 to reconcile the amount of the advance payments they received with the actual amount of the premium tax credit they were eligible for based on their household income for the year.

- A single individual purchased health insurance through the Health Insurance Marketplace and did not receive advance payments of the premium tax credit to help pay for their monthly insurance premiums. At the end of the year, they may use Form 8962 to claim the premium tax credit they are eligible for based on their household income for the year.

- A family moved to a new state and enrolled in a new health insurance plan through the Health Insurance Marketplace mid-year. They may use Form 8962 to calculate the premium tax credit they are eligible for based on their household income for the portion of the year they were enrolled in the new plan.

In each of these cases, Form 8962 is used to calculate the premium tax credit that the individual or family is eligible for based on their household income for the year. It is important to note that the form must be filled out correctly and in compliance with applicable laws and regulations to avoid errors and potential penalties.