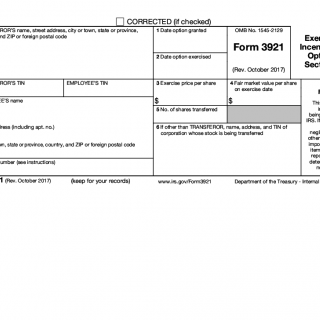

IRS Form 3921

Form 3921 is an IRS tax form used to report the exercise of an incentive stock option (ISO). It must be filled out by the employer and includes information such as the name and address of the employer, the optionee's name and address, the date the option was granted, the date the option was exercised, and the amount of the exercise price paid. The form must also include the fair market value of the stock at the time it was exercised, as well as any applicable withholding taxes. The form must be submitted to the IRS and the optionee within 30 days of the exercise date.

The IRS uses the data from Form 3921 to track the exercise of incentive stock options. It helps the IRS monitor and enforce the rules regarding these options, and also helps them ensure that employers properly report the income associated with them. The data from the form is used to determine the taxes that are owed on the exercise of the options, as well as any applicable withholding taxes.