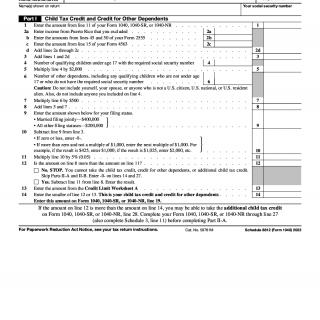

IRS Form 8812

Schedule 8812 (Form 1040) is a tax form used by the Internal Revenue Service (IRS) to calculate the Additional Child Tax Credit (ACTC). It is typically used by individuals who have at least one qualifying child and are claiming the credit. The form requires the taxpayer to provide information such as their name, Social Security number, and filing status, as well as information about each qualifying child, such as the child's name, date of birth, and Social Security number.

Additionally, the form requires information about the taxpayer's income and the credit they are claiming. It is important to note that the taxpayer must provide documentation that proves they are eligible for the credit, such as a Social Security card, birth certificate, or adoption decree.

Form 8812 (Form 1040) must be filed with your federal income tax return. You can submit it electronically via the IRS website or mail it in with your return. If you are filing a paper return, make sure to include the form with your return and sign it. If you are filing electronically, your return will be automatically submitted when you complete the form. If you are submitting the form separately, you can send it to the IRS address listed on the form.

Tips

- Read the instructions carefully before filling out Form 8812. Make sure that you understand all of the requirements and that you are filling out the form correctly.

- Make sure that you have all of the necessary information before you begin. This includes your Social Security number, income information, tax filing status, and any other documents needed for the form.

- Double-check your entries and make sure that you have entered all of the information correctly. This includes entering the correct Social Security numbers, income amounts, and tax filing status.

- Make sure to sign the form before submitting it.

- Submit the form in a timely manner. It is important to submit the form on or before the due date to avoid any penalties.

Some addresses for submitting the form by mail

- Internal Revenue Service, Attn: Mail Stop 6052, P.O. Box 1214, Los Angeles, CA 90084-1214

- Internal Revenue Service, Attn: Mail Stop 6052, P.O. Box 4091, San Francisco, CA 94120-4091

- Internal Revenue Service, Attn: Mail Stop 6052, P.O. Box 4554, San Jose, CA 95150-4554

- Internal Revenue Service, Attn: Mail Stop 6052, P.O. Box 934001, Sacramento, CA 94244-0001

- Internal Revenue Service, Attn: Mail Stop 6052, P.O. Box 25136, Oklahoma City, OK 73125-0136

- Internal Revenue Service, Attn: Mail Stop 6052, P.O. Box 1208, Tampa, FL 33601-1208

- Internal Revenue Service, Attn: Mail Stop 6052, P.O. Box 931000, Louisville, KY 40293-1000

- Internal Revenue Service, Attn: Mail Stop 6052, P.O. Box 804525, Chicago, IL 60680-4525

- Internal Revenue Service, Attn: Mail Stop 6052, P.O. Box 95045, Cleveland, OH 44101-5045

- Internal Revenue Service, Attn: Mail Stop 6052, P.O. Box 37973, Philadelphia, PA 19101-7973