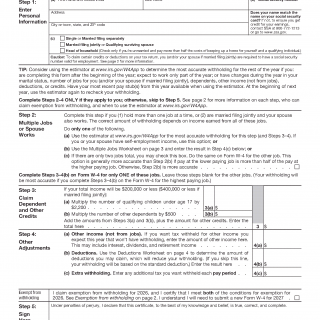

IRS Form W-4. Employee's Withholding Certificate

Form W-4, Employee’s Withholding Certificate, is an Internal Revenue Service document used by employees to provide their employer with information necessary to determine the amount of federal income tax to withhold from wages. The form establishes how withholding should be calculated based on filing status and other withholding-related factors defined by federal tax law.

Purpose of Form W-4

The purpose of Form W-4 is to communicate withholding information from an employee to an employer so that federal income tax can be withheld correctly from payroll. The form does not calculate tax liability and does not determine the final amount of tax owed or refunded when a return is filed.

Who Uses This Form

Form W-4 is completed by employees who receive wages subject to federal income tax withholding. Employers use the information provided on the form solely to apply payroll withholding rules when issuing wages.

How the Form Is Used

An employee completes Form W-4 and submits it to their employer. The employer relies on the entries on the form to apply withholding tables and formulas prescribed by the Internal Revenue Service. The form is retained by the employer and is not routinely filed with the Internal Revenue Service.

Information Reflected on the Form

Form W-4 captures information relevant to withholding, including filing status, adjustments related to multiple jobs or working spouses, claimed dependents and credits, other income or deductions affecting withholding, and any additional amounts to be withheld. The form also allows certain employees to certify exemption from withholding when specific conditions are met.

Relationship to Other IRS Documents

Form W-4 operates within the federal withholding system and is distinct from income tax returns and information reporting forms. It is used during the payroll process and does not replace forms filed to report income, claim deductions, or reconcile tax liability.

Additional Explanations and Context

Detailed explanations about when Form W-4 is required, how it is updated, and how specific sections apply in different employment situations are provided in the related notes section for this form.