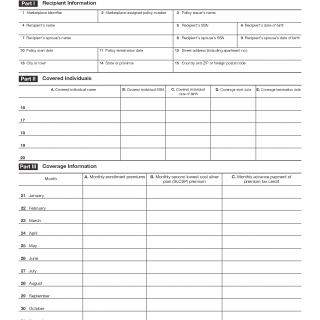

IRS Form 1095-A. Health Insurance Marketplace Statement

IRS Form 1095-A is an informational document issued by a Health Insurance Marketplace to report health coverage obtained through a Marketplace plan. The form records enrollment details, covered individuals, and any advance payments of the premium tax credit, reflecting how Marketplace coverage was administered during the year.

Official role of Form 1095-A

Form 1095-A exists to document Marketplace health insurance coverage and to support the administration of the premium tax credit. It distinguishes Marketplace-based coverage from employer-sponsored or other non-Marketplace coverage, which are reported under different forms and reporting systems.

Who issues Form 1095-A

The form is issued exclusively by the Health Insurance Marketplace where coverage was obtained. This may be the federal Marketplace or a state-based Marketplace. The individual listed on the form does not prepare, complete, or modify it.

What information the form records

Form 1095-A identifies the policy, the covered individuals, and the months during which Marketplace coverage applied. It also records the amounts associated with the benchmark plan and any advance payments of the premium tax credit that were applied during the coverage year.

How the form functions within the system

The Marketplace reports the same coverage and payment information shown on Form 1095-A directly to the Internal Revenue Service. The form serves as a system record used to evaluate Marketplace coverage and to reconcile advance premium tax credit payments during tax processing.

Relationship to tax filing

Form 1095-A is not filled out by the taxpayer and is not attached to a tax return. Its information is used during tax filing to reconcile or claim the premium tax credit, but the form itself is not submitted. The presence of the form does not by itself determine a refund or balance due.

What the form does not do

Form 1095-A does not create a filing obligation, does not impose a penalty, and does not represent a notice of tax due. It is an informational statement that reflects Marketplace coverage activity rather than a directive or instruction.

Relation to other Forms 1095

Form 1095-A is used only for Marketplace coverage. Coverage reported by insurers or government programs outside the Marketplace is documented on Form 1095-B, while coverage offered or provided by applicable large employers is reported on Form 1095-C. Each form corresponds to a distinct coverage reporting system.

For a practical, process-based explanation of why this form is issued and how it is used in real situations, see Form 1095-A practical overview.