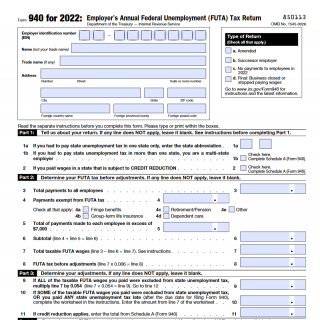

IRS Form 940. Employer’s Annual Federal Unemployment (FUTA) Tax Return

IRS Form 940 is a tax form used by employers to report their annual Federal Unemployment Tax Act (FUTA) tax liability. The form consists of several parts, including employer identification information, quarterly wage and tax data, and an annual summary of FUTA tax liability.

The form is drawn up by employers who are subject to FUTA tax and have paid wages of $1,500 or more in any calendar quarter during the current or previous calendar year. The parties involved are the employer and the Internal Revenue Service (IRS).

When compiling Form 940, employers should ensure that they accurately report their FUTA tax liability based on the wages paid to their employees during the year. They should also ensure that they correctly calculate any credits they are entitled to, such as the credit for state unemployment taxes paid.

Real cases of using Form 940 include employers who have paid wages of $1,500 or more in any calendar quarter during the current or previous calendar year. For example, if an employer paid wages of $2,000 during the first quarter of the current year, they would be required to file Form 940.

The advantages of filing Form 940 include compliance with federal tax laws and the ability to claim any credits for state unemployment taxes paid. However, problems can arise if the form is not filled out correctly, such as underreporting of FUTA tax liability or miscalculation of credits. This can result in penalties and interest assessed by the IRS. Therefore, it is important for employers to carefully review and accurately complete Form 940 to avoid any potential issues.

Form 940 is related to several other tax forms, including Form 941 (Employer's Quarterly Federal Tax Return), Form W-2 (Wage and Tax Statement), and Form W-3 (Transmittal of Wage and Tax Statements). These forms are used to report payroll taxes and wage information to the IRS.

Mailing Addresses for Form 940

| If you’re in ... | Mail return without payment ... | Mail return with payment ... |

|---|---|---|

| Connecticut, Delaware, District of Columbia, Georgia, Illinois, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, Wisconsin |

Department of the Treasury |

Internal Revenue Service P.O. Box 806531 Cincinnati, OH 45280-6531 |

| Alabama, Alaska, Arizona, Arkansas, California, Colorado, Florida, Hawaii, Idaho, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wyoming | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0046 |

Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

| Puerto Rico, U.S. Virgin Islands | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |

Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

| If the location of your legal residence, principal place of business, office, or agency is not listed … | Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 |

Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |

| EXCEPTION for tax-exempt organizations, federal, state, and local governments, and Indian tribal governments, regardless of your location | Department of the Treasury Internal Revenue Service Ogden, UT 84201-0046 |

Internal Revenue Service P.O. Box 932000 Louisville, KY 40293-2000 |