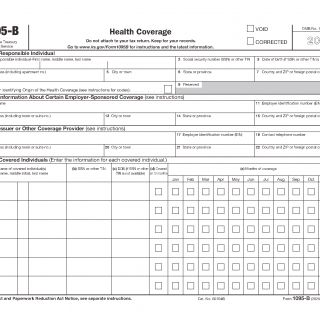

IRS Form 1095-B. Health Coverage

IRS Form 1095-B is an informational document used to report minimum essential health coverage that was provided outside the Health Insurance Marketplace. The form serves as an official record that qualifying health coverage existed for specific individuals and months during the year and reflects how that coverage was recorded within the federal health coverage reporting system.

Official role of Form 1095-B

Form 1095-B exists to document the presence of minimum essential coverage as defined under federal health coverage rules. It supports system-level verification of coverage status and helps distinguish non-Marketplace coverage from Marketplace and large employer coverage, which are reported under different forms.

Who is responsible for issuing the form

The form is issued by the entity that provided the coverage. This can include an insurance company, a government agency administering programs such as Medicaid, Medicare, or CHIP, or a plan sponsor responsible for reporting coverage. The individual listed on the form does not prepare, complete, or alter it.

What information the form records

Form 1095-B identifies the responsible individual, the coverage provider, and the individuals covered under the policy. It records whether coverage applied for the entire year or for specific months and confirms that the coverage met the definition of minimum essential coverage for those periods.

How the form functions within the reporting system

The coverage information shown on Form 1095-B is reported by the coverage provider directly to the Internal Revenue Service. The copy furnished to the individual mirrors that system record and is provided for transparency and reference. The form itself is not used to calculate tax credits or reconcile payments.

Relationship to tax filing

Form 1095-B is not attached to a tax return and is not required to be submitted when filing taxes. It does not establish eligibility for the premium tax credit, does not affect refunds or balances due on its own, and does not create a filing obligation. Its role is limited to documenting coverage status within the reporting framework.

When the form may or may not be furnished automatically

Depending on applicable rules for the reporting year, coverage providers may furnish Form 1095-B automatically or may make it available upon request through a posted notice. In either case, the reporting obligation to the Internal Revenue Service is satisfied independently of how the individual copy is delivered.

Relation to other Forms 1095

Form 1095-B is used only for coverage reported by insurers, government programs, and certain plan sponsors. Coverage obtained through a Health Insurance Marketplace is reported on Form 1095-A, while coverage offered or provided by applicable large employers is reported on Form 1095-C. Each form corresponds to a separate reporting system.

For a process-based explanation of why this form is issued, when it appears, and what it means in practice, see Form 1095-B practical overview.