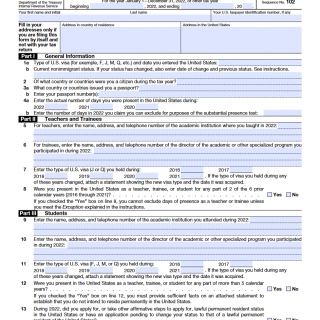

IRS Form 8843. Statement for Exempt Individuals and Individuals with a Medical Condition

The IRS Form 8843, or Statement for Exempt Individuals and Individuals with a Medical Condition, is a tax form that must be completed by certain nonresident aliens who are in the United States for a limited time. The main purpose of this form is to provide information about the individual's presence in the US and claim an exemption from certain taxes.

The form consists of several important fields, including the individual's personal information, immigration status, and details about their time spent in the US. It is important to note that this form is not a tax return and does not provide any tax benefits or deductions.

When compiling the form, individuals will need to provide information about their immigration status, including their visa type and date of entry into the US. They will also need to provide details about any days spent in the US during the current and previous tax years.

This form is typically used by nonresident aliens who are in the US for educational or medical purposes, as well as individuals who are exempt from certain taxes under a tax treaty.

Strengths of this form include its ability to provide an exemption from certain taxes for eligible individuals, while weaknesses may include confusion around eligibility requirements and potential penalties for noncompliance.

Alternative forms that may be relevant include the Form 1040NR or Form 1040NR-EZ, which are tax returns for nonresident aliens. These forms provide a more comprehensive overview of an individual's tax situation and may be required in addition to the Form 8843.

Once the Form 8843 is properly completed, it can be submitted to the IRS for review. The form is not filed with a tax return and does not require any additional documentation. It is important to retain a copy of the form for personal records.

Overall, the IRS Form 8843 can be a helpful tool for nonresident aliens who are in the US for a limited time and need to claim an exemption from certain taxes. It is important to carefully consider all eligibility requirements and seek the advice of a qualified tax professional before submitting the form.