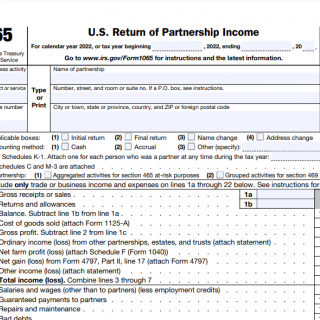

IRS Form 1065. U.S. Return of Partnership Income

Form 1065, also known as the U.S. Return of Partnership Income, is an IRS tax form used by partnerships to report their income, gains, losses, deductions, credits, and other information.

The form consists of multiple parts, including Part I, which is for general information about the partnership, and Part II, which is for reporting income and expenses. Other parts include schedules for reporting specific types of income and deductions, such as rental income or charitable contributions.

The most important fields on the form are those related to income, expenses, and deductions. These fields include items such as gross receipts, cost of goods sold, salaries and wages, and depreciation expenses.

This form is typically used by partnerships, which are business structures that are owned and operated by two or more people. The parties involved in this document are the partnership and the IRS.

When compiling this form, it is important to ensure that all income, expenses, and deductions are properly reported and that the partnership meets all of the eligibility criteria for using the form.

The main advantage of using Form 1065 is that it allows partnerships to report their income and expenses in a standardized format that is recognized by the IRS. This can help ensure that the partnership is in compliance with tax laws and regulations.

One potential problem that can arise when filling out the form is if the partnership does not accurately report all of its income, expenses, and deductions. This can result in an incorrect or incomplete tax return, which can lead to penalties and interest charges.

Related forms include Form 1065-B, which is used by certain types of partnerships to report changes in ownership, and Form 1120-S, which is used by S corporations to report their income, gains, losses, deductions, and credits. An alternative to using Form 1065 is to use tax preparation software or to hire a tax professional to prepare the tax return.

Form 1065 can be submitted by mail to the appropriate IRS address, or it can be filed electronically using the IRS's e-file system. Copies of the form should be kept for the partnership's records.