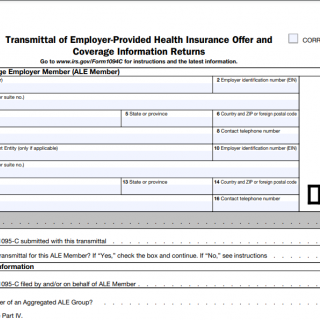

IRS Form 1094-C. Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns

Form 1094-C is a tax form used by employers with 50 or more full-time employees, including full-time equivalent employees, to summarize the information reported on Form 1095-C. The form consists of two parts.

- Part I of Form 1094-C includes information about the employer, including the employer's name, address, and employer identification number (EIN).

- Part II of Form 1094-C includes information about the number of employees offered health insurance coverage, the number of employees who actually enrolled in the coverage, and the total cost of the coverage.

The most important fields on Form 1094-C are the employer's name, address, and EIN, as well as the number of employees offered and enrolled in health insurance coverage.

Form 1094-C is compiled by employers with 50 or more full-time employees, including full-time equivalent employees, who are required to offer health insurance coverage to their employees under the Affordable Care Act. The parties to the document are the employer and the IRS.

When compiling Form 1094-C, employers should consider the accuracy of the information provided, as well as the timing of the form's distribution to the IRS.

The advantages of Form 1094-C include providing the IRS with the necessary information to verify that employers are complying with the requirements for offering health insurance coverage under the Affordable Care Act.

The problems that can be encountered when filling out Form 1094-C include inaccuracies in the information provided, as well as confusion about the requirements for offering health insurance coverage under the Affordable Care Act.

Related forms include Form 1095-C, which is used to report information about an employee's health insurance coverage, and Form 1094-B, which is used by insurers or employers with fewer than 50 full-time employees to summarize the information reported on Form 1095-B.

Form 1094-C is submitted to the IRS along with Form 1095-C. Copies of Form 1095-C are also distributed to employees. The form is submitted electronically if required by the IRS, otherwise, it can be mailed to the IRS. Instances of the form should be stored by the employer for at least three years after the due date of the tax return on which the form was filed.