Mileage Reimbursement form

The mileage reimbursement form is a document used to request reimbursement of expenses incurred while driving for business purposes. The purpose of the form is to provide a record of the miles driven and the expenses incurred, such as gas, tolls, and parking fees.

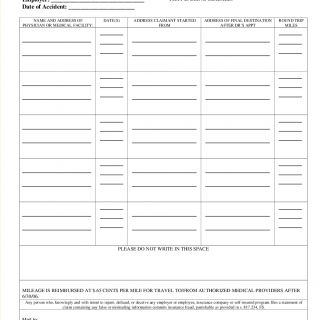

The form consists of several parts, including the employee's personal information, the date and time of the trip, the starting and ending locations, the purpose of the trip, and the number of miles driven. Important fields to consider when compiling the form include the date, the purpose of the trip, and the starting and ending locations.

The parties involved in the form are the employee who drove for business purposes and the employer who is responsible for reimbursing the employee. Data required when compiling the form includes the starting and ending locations, the purpose of the trip, the date and time of the trip, and the number of miles driven. Documents that must be attached additionally include receipts for gas, tolls, and parking fees.

Application examples and use cases of the mileage reimbursement form include salespeople who travel to meet clients, delivery drivers who make business deliveries, and consultants who travel to client sites. Benefits of the form include ensuring that employees are reimbursed for expenses incurred while driving for business purposes, which can help to retain employees and improve morale. Challenges and risks associated with the form include the potential for fraudulent claims and the need for accurate record-keeping.

Related and alternative forms to the mileage reimbursement form include per diem forms and expense report forms. Per diem forms are used to reimburse employees for meals and lodging, while expense report forms are used to document all business expenses, including travel expenses. The main difference between the mileage reimbursement form and these forms is that the mileage reimbursement form is specifically for reimbursing employees for driving expenses.

The mileage reimbursement form affects the future of the participants by ensuring that employees are reimbursed for expenses incurred while driving for business purposes, which can help to retain employees and improve morale. The form is typically submitted to the employer's accounting or finance department for processing and is stored in the employee's personnel file.