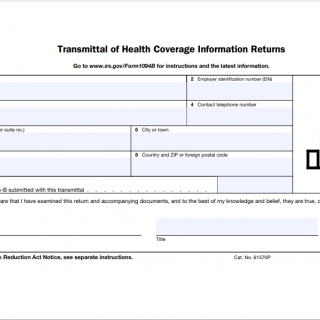

IRS Form 1094-B. Transmittal of Health Coverage Information Returns

Form 1094-B is a transmittal form that is used to accompany Form 1095-B when it is filed with the IRS. The form is used by insurance providers or self-insured employers to report information about the individuals who are covered by their health insurance plans.

The form consists of four parts:

- Part 1: Identification of filer, includes information about the entity that is filing the form, such as its name, address, and EIN (Employer Identification Number).

- Part 2: Employer contact information, includes information about the person to contact in case the IRS needs to contact the entity that is filing the form.

- Part 3: Number of Forms 1095-B transmitted, includes information about the number of Forms 1095-B that are being transmitted with the Form 1094-B.

- Part 4: Certification, includes a certification that the information provided in the form is accurate and complete.

The most important fields in the form are the entity's name and EIN, the number of Forms 1095-B transmitted, and the certification.

This form is compiled by insurance providers or self-insured employers who are required to provide health insurance coverage to individuals under the Affordable Care Act (ACA). The parties involved in the document are the insurance providers or self-insured employers who are responsible for providing health insurance coverage to individuals.

When compiling the form, it is important to make sure that all the information provided is accurate and complete. Additionally, the form must be filed on time to avoid penalties.

The advantages of the form include:

- It helps insurance providers or self-insured employers comply with the ACA reporting requirements.

- It provides the IRS with information about the individuals who are covered by health insurance plans.

The problems that can be encountered when filling out the form include:

- The form can be complex and difficult to understand.

- The information provided on the form must be accurate and complete, which can be time-consuming and require significant effort.

Related forms include Form 1095-B, which is the form that is transmitted with Form 1094-B. Alternative forms include Form 1094-C, which is used by applicable large employers to report information about the health insurance coverage they provide to their employees.

The form is submitted to the IRS, along with Form 1095-B, through the Affordable Care Act Information Returns (AIR) system. Instances of the form are stored by the IRS.