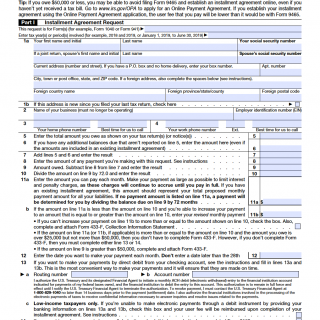

IRS Form 9465. Installment Agreement Request

The IRS Form 9465, also known as the Installment Agreement Request, is designed to help taxpayers who are unable to pay their full tax liabilities at once. The main purpose of this form is to request an installment agreement with the IRS, allowing taxpayers to pay off their debts in manageable monthly or quarterly payments.

The form consists of several important fields, including the taxpayer's personal information, financial details, and the type of installment agreement being sought. Taxpayers must also indicate whether they are requesting approval for a Direct Debit Installment Agreement.

When compiling the form, taxpayers will need to provide information about their income, expenses, assets, and debts. They will also need to provide details about their current tax liabilities and any balances owed for the current filing year. In some cases, additional documentation may be required, such as proof of income or an itemized list of expenses. It is important to note that taxpayers must pay any balances owed for the current filing year before submitting the Form 9465.

This form can be used in a range of situations, such as when a taxpayer is experiencing financial hardship, facing unexpected expenses, or dealing with a decrease in income. The IRS will assess the taxpayer's financial situation and determine the amount of their payments and the length of the repayment plan.

Strengths of this form include providing a manageable way for taxpayers to satisfy their tax debt, while weaknesses may include limitations on the amount of debt that can be repaid and the lack of protection from IRS levy or collection activity.

Alternative forms that may be relevant include the Offer in Compromise, which allows taxpayers to settle their tax debt for less than the full amount owed, and the Collection Information Statement, which provides detailed financial information to the IRS.

Once the Form 9465 is properly completed, it can be submitted to the IRS for review. If approved, the taxpayer must adhere to the terms of the agreement. The form is stored by the IRS and can be accessed in the future as needed.

Overall, the IRS Form 9465 can be a helpful tool for taxpayers who are struggling to pay their tax debts. It is important to carefully consider all options and seek the advice of a qualified tax professional before submitting the form.