Customer Notification Letter form 8300

The Customer Notification Letter Form 8300 is a document used by businesses to notify their customers of the filing of the IRS Form 8300. The Form 8300 is used to report cash transactions over $10,000 to the Internal Revenue Service (IRS).

The main purpose of the Customer Notification Letter Form 8300 is to inform customers of their reported transactions and provide them with information about their rights and obligations under the law.

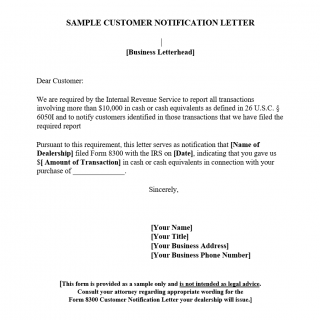

The form consists of several important fields, including the name and address of the business, the name and address of the customer, the date of the transaction, the amount of the transaction, and a description of the goods or services purchased.

The parties involved in the form are the business and the customer. It is important for businesses to compile this form accurately and in a timely manner in order to avoid any potential penalties or legal issues.

When compiling the form, businesses will need to provide specific data about the transaction, including the date, amount, and description of the goods or services purchased. Additionally, businesses will need to attach a copy of the Form 8300 that was filed with the IRS.

Sample Customer notice

[Business Name]

[Business Address]

[City, State ZIP Code]

[Date][Customer Name]

[Customer Address]

[City, State ZIP Code]Dear [Customer Name],

We are writing to inform you that we have filed the IRS Form 8300 to report a cash transaction over $10,000 that occurred on [Date of Transaction]. The transaction involved the purchase of [Description of Goods or Services] for a total amount of [Amount of Transaction].

As a valued customer, we want to ensure that you are aware of this filing and understand your rights and obligations under the law. Please note that this filing is a requirement of the Internal Revenue Service (IRS) and is intended to help prevent money laundering and other illegal activities.

If you have any questions or concerns regarding this filing, please do not hesitate to contact us. We appreciate your business and look forward to serving you in the future.

Sincerely,

[Business Name]

Application examples of the form include situations where a business sells a high-priced item, such as a car or jewelry, for cash. In this case, the business would need to file the Form 8300 and provide the Customer Notification Letter to the customer.

The benefits of using the form include compliance with IRS regulations and the avoidance of potential penalties or legal issues. However, there are also challenges and risks associated with using the form, such as the potential for customer dissatisfaction or misunderstanding.

Related forms include the Form 8300 itself, which is used to report cash transactions over $10,000 to the IRS. Alternative forms may include electronic filing options or other methods of notifying customers of their reported transactions.

The form can have an impact on the future of the participants, as it can help to prevent potential issues with the IRS and maintain good customer relationships.

The form is submitted to the customer by the business and is typically stored in the business's records for future reference.